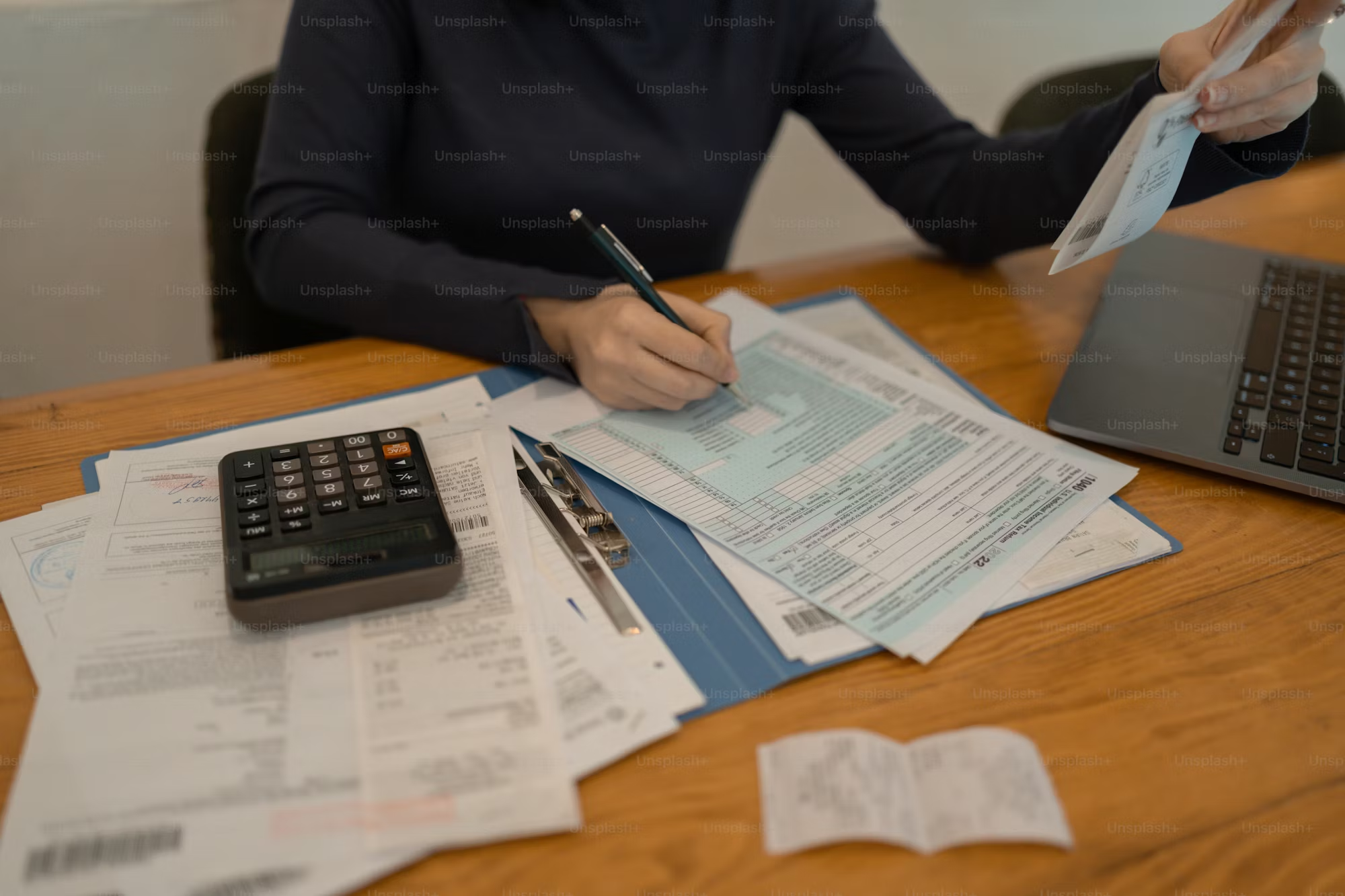

This professional course, offered by the Institute of Chartered Accountants of India (ICAI), trains students to become expert accountants and auditors.

5 Years (including training)

₹50K - ₹2L (total course)

Competitive Exam Required (CA Foundation)

9/10 (High demand for CAs)

Stricter financial regulations increase demand for CAs.

Absolutely FREE – No Signup Required!

Unlock your English fluency with our exclusive bundle of 10+ powerful e-books, perfect for students, job seekers, and learners!

Limited-Time Bonus – Yours FREE!

Start Learning Instantly

Build Your Brand. Launch Your Business. Automate Smartly.

Grab it Now for Just ₹499! ₹4899

Lifetime Access Included

Amplify Campaigns. Boost Conversions. Engage Smarter.

Grab it Now for Just ₹499! ₹4899

Lifetime Access Included

Present Insights Better. Build Dashboards. Upskill Strategically.

Grab it Now for Just ₹499! ₹4899

Lifetime Access Included